what type of car loan can i get with a 700 credit score

You may have a better auto FICO score than a normal FICO score so your car loan interest rate with a 700 credit score could be. The Comfort Of a Simple Car Loans Is Priceless.

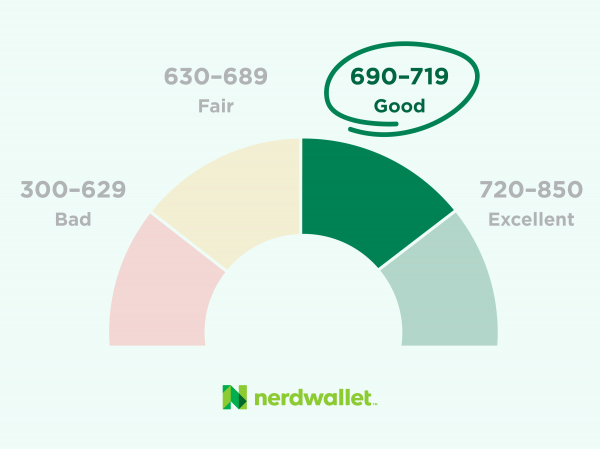

700 Credit Score Is It Good Or Bad How To Build Higher Nerdwallet

Auto Credit Express is all about getting you a quick decision on your auto loan.

. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the. Just keep all the information given above in mind. Buyers with a credit score of between 500-589 for example are looking at interest.

Click Now Apply Online. 399 - 2999. Individuals with a 700 FICO credit score pay a normal 468 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 590-619 were charged.

On average the credit score for a used-car loan or lease was 665 according to the data while the average score for a new-car loan or lease was 732. As of this writing here are some of the nations top auto lenders and the way they see credit scores of 700. Ad All Requests Accepted New or Used Car Immediate Response.

Your score is in the 700-749 credit. Subprime borrowers on the other hand and those with lower credit scores dont fare as well. You can do that by checking your credit score and credit report to get an idea of which areas you need to address.

Ad Used Car Loans from 3k to 45k. The average auto loan interest rate is 386 for new cars and 821 for used cars according to Experians State of the. Here are five reasons why you might get rejected even though you have a great score.

Most dealerships will advertise plenty of incentives for buying a new vehicle such as. The key is to work with the right lender and pick the right vehicle. Bank of America - Tier 2.

Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. The thinness and lack of different types of credit especially if you have never had an installment loan can kill an FICO auto score. Using the same FICO loan savings calculator in the example above heres how much the calculator estimated youd spend on interest in total based on credit score.

Answer 1 of 7. Ad Read Expert Reviews Compare The Best Car Loans Options. However even with a score of 700considered a good.

The average rate for a used car. As you can see a 700 credit score puts you in the good or prime category for financing making 700 a good credit score to buy a car. Try this site where you can find the best solutions for all your personal financial needs.

Apply Drive Today. In conclusion a credit score of 450 is not the best but it is not impossible to get a loan. Your credit score can impact your maximum loan amount and the interest rate you receive on a loan or line of credit.

Apply Today For Low Rates. Trusted Over 17 Years. Auto Credit Express is consistently among our top picks for a bad credit car loan for many reasons starting with the prequalification form that takes only about 30 seconds to.

Individuals with a 770 FICO credit score pay a normal 34 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 500-589 were charged. A person with a 700 credit score somewhere in their scoring range is at a pivotal point of their financial decisions. But pushing out your loan term means you pay much.

With a credit score of 650-659 you should qualify for a subprime APR rate which will be higher than someone with a 700 or 800 credit score. This is because with a 700 average a person can most likely. Yes you can get a car loan with 600 credit score.

It goes beyond bad or scant credit even bankruptcies. The report also found. Common ways to improve your credit score include getting.

The average interest rate for a new car loan with a credit score of 700 to 709 is 351. What interest rate can I get on a car. After all in our earlier example if we extend the term from 48 to 72 months the monthly payment drops to just 17523.

Yes its possible to get a bad credit car loan and only make a 700 down payment. Compare Rates Save Money. Youll most likely be able to secure auto financing if your credit score isnt deep subprime or very bad which is considered to be 450 or less but it will cost.

There are still some options available to you but you may have to pay a higher interest rate or put down a. 699 credit score is tier 3 Bank of the West - Tier 4.

What Credit Score Is Needed To Buy A Car Lendingtree

Best Auto Loan Rates With A Credit Score Of 700 To 709

Credit Score A Sneak Peak Into The Fico Score Credit Score Good Credit Good Credit Score

700 Credit Score Improve Credit Score Improve Credit Credit Score Repair

8 Best Loans Credit Cards 650 To 700 Credit Score 2022

4 Ways To Get The Best Personal Loan Interest Rate Maintain A Good Credit Score Finance Loans Good Credit Credit Score

Don T Let Your Credit Score Drop Credit Card Solution Tips And Advice Improve Credit Score Credit Score Credit Score Repair

700 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Is 700 A Good Credit Score To Buy A Car Green Light Auto Credit

Know What Credit Score Level Is Required To Get Any Loan Credit Score Good Credit Free Credit Score

Tips To Get No Credit Auto Loan Approval Bad Credit Car Loan Car Loans Bad Credit